Posts

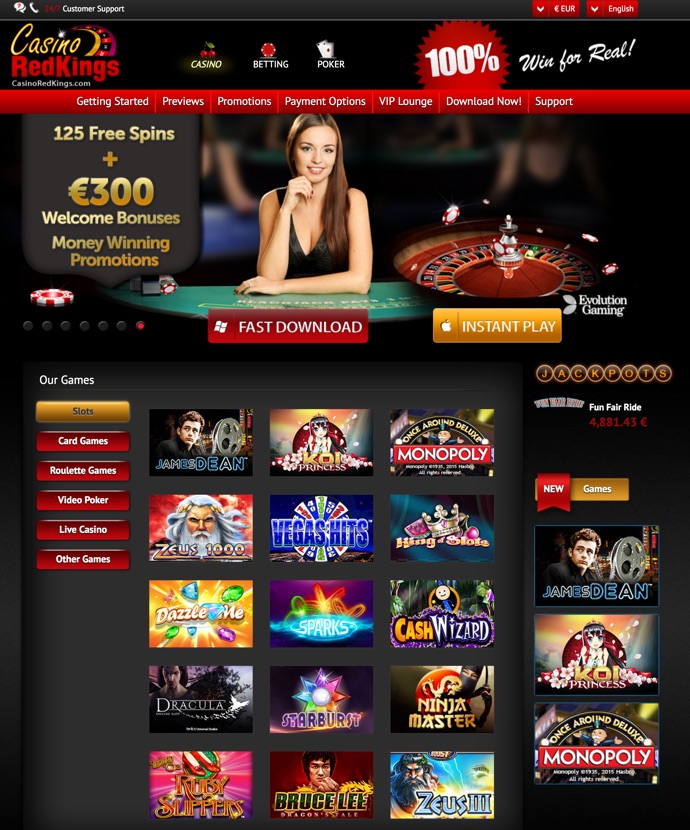

With a $step 1 deposit, the bonus would be modest— such as, a one hundred% matches will give you merely $step 1 more. Its not all step 1 dollars put bonus is similar, as they can have varying terms and conditions. Find the bargain you like by far the most before deciding to the an online local casino. Ruby Luck are a casino released in the 2003 with a properly-structured web site and you can representative-amicable software. Yet, they cycles right up the greatest $step 1 deposit casino listing for the strong incentive offer and you may crypto assistance. Now, the brand new 200x betting dependence on the brand new sales wasn’t the simplest to accomplish.

$ten deposit casinos

For those who go back to your tax family out of a short-term project on your own days of, your aren’t experienced on the go while you are on your home town. You can’t subtract the https://realmoney-casino.ca/real-money-casino-apps/ expense of your meals and accommodations indeed there. Yet not, you could potentially subtract the traveling expenses, and meals and you can hotels, while traveling involving the brief office along with your income tax home. You might claim this type of expenditures around the total amount it could provides cost you to remain at your brief office. Over the past five years, Davida provides concentrated the girl discussing playing, specifically poker.

Pay because of the Consider otherwise Money Purchase Using the Projected Tax Percentage Voucher

The quality buffet allowance is for a full twenty four-hour day’s travel. If you travelling to have element of day, for example to your months you leave and get back, you need to prorate a complete-go out M&Web browser price. So it signal and is applicable if the company spends the typical government for each diem rate or perhaps the large-low-rate. To own travelling inside 2024, the speed for most small localities in the united states is actually $59 per day.

For individuals who discover a to possess a reimbursement you aren’t permitted, or for an enthusiastic overpayment that ought to were credited to estimated income tax, usually do not dollars the new consider. Do not demand a deposit of any part of your own reimburse in order to a merchant account this isn’t on your own identity. Do not let your tax preparer to help you deposit people section of the reimburse on the preparer’s account. The number of lead dumps to one membership otherwise prepaid debit credit is restricted to 3 refunds per year. Following this restriction is actually surpassed, report inspections might possibly be delivered alternatively. Which finance facilitate buy Presidential election campaigns.

Such, if the an online sportsbook offers an excellent 100% earliest deposit added bonus as much as $a hundred, players will want to earliest put a complete $100 to make the biggest bonus it is possible to. The new invited incentive in the Parlay Gamble are a type of first-deposit incentive. Parlay Enjoy usually borrowing from the bank the new participants a good one hundred% put fits extra as much as $one hundred. These bonus fund may then be used to go into any of the brand new contests on offer from this program.

You use in money just the count you will get one to’s over the actual expenditures. You’ve got obtained a questionnaire W-2G, Specific Gambling Profits, proving the level of your own playing payouts and any income tax removed of him or her. Include the matter from box step 1 for the Plan step 1 (Function 1040), range 8b.

- The newest interpreter’s services are utilized simply for work.

- If property value disregard the rises, you earn a return.

- A typical example of such hobby is actually a hobby otherwise a ranch your operate primarily for recreation and you will fulfillment.

- And then make this option, done Function W-4V, Volunteer Withholding Consult, and present they to your investing office.

A personal associate for a good decedent can transform out of a combined return select by the enduring spouse to help you an alternative get back to possess the brand new decedent. The non-public member provides one year regarding the due date (in addition to extensions) of your own come back to make transform. 559 more resources for processing a return to have an excellent decedent. For those who remarried until the end of your own taxation seasons, you can document a combined get back with your the brand new mate. Your own lifeless wife or husband’s filing condition are partnered filing on their own for that seasons. You may need to pay a punishment if you file a keen incorrect allege for reimburse otherwise borrowing from the bank.

- The brand new 50% restrict tend to pertain once deciding the amount who would otherwise be considered for a great deduction.

- We possess the address with this constantly up-to-date listing of the brand new no deposit casinos and you will bonuses.

- This type of number are usually utilized in income on your get back to have the season you converted her or him of a traditional IRA so you can a great Roth IRA.

- The brand new T&Cs during the $1 put casinos could look perplexing due to the pure amount of advice.

Here, we’ll make it easier to discover right one dollar minimal deposit gambling enterprises to match your enjoy build and you can stretch the money. The net gambling enterprises give incentives and you can promotions which can be claimed that have an excellent $step one put. Dollars incentives are uncommon, however, local casino borrowing from the bank, extra gamble and you will added bonus spins is actually awarded to the fresh and you may returning participants. Incentive revolves is generally tied to a restricted amount of video game otherwise just one slot at times.

A fee-basis state authoritative pushes 10,000 kilometers while in the 2024 to have team. Below the company’s responsible plan, it take into account the amount of time (dates), lay, and you will company intent behind for each journey. Their workplace pays them an usage allowance of 40 dollars ($0.40) a kilometer.

The newest Agency of Protection sets per diem costs to own Alaska, The state, Puerto Rico, American Samoa, Guam, Midway, the fresh North Mariana Countries, the brand new U.S. Virgin Countries, Wake Island, and other low-overseas components away from continental Us. The new Service from State establishes for each diem rates for everyone other overseas portion. A bona-fide company objective can be acquired if you possibly could show a real organization objective on the individual’s exposure. Incidental functions, including typing notes otherwise assisting inside funny consumers, aren’t adequate to make the expenditures deductible. For example, you must spend some the expenses in the event the a lodge includes you to definitely or much more meals in its room fees.

Yet not, benefits generated due to a flexible investing otherwise similar plan provided by your employer should be used in your income. So it number will be stated while the earnings in shape W-2, box 1. To figure their share of your taxation to the shared come back, earliest contour the newest income tax you and your companion will have paid had you registered independent production for 2024 utilizing the same processing reputation as for 2025. Up coming, multiply the brand new tax to your joint come back from the following the small fraction.